THE VIEW FROM SHANGHAI:

THE IMPACT OF COVID-19

AND THE LONG-TERM PROMISE

OF THE DIAMOND MARKET IN CHINA

THE IMPACT OF COVID-19

AND THE LONG-TERM PROMISE

OF THE DIAMOND MARKET IN CHINA

JUNE 22, 2020

Lin Qiang

President

Shanghai Diamond Exchange

The economic crisis that struck in the wake of the COVID-19 pandemic impacted in unprecedented ways on China’s jewelry retail markets and their supply chains. This was self-evident from the data collected at the Shanghai Diamond Exchange (SDE), where we saw polished imports through SDE into China decline by 70 percent during the first four months of 2020.

But, with much of the lockdown now lifted, we are seeing businesses springing back. Many have returned to full operation and Chinese consumers are coming back to the shopping malls. We expect to see trade and the market gradually ramp up in the coming months. Already in April we saw a 5.4 percent increase in jewelry market sales when compared with March.

Even then, it is likely that the diamond industry will be changed permanently. We will share our thoughts about this in the following paragraphs.

However, we would also like to stress that, from a long-term perspective, the crisis will not alter the direction of the Chinese industry. We remain strongly confident about the resilience and the growth potential of our country’s diamond market.

The lingering impact of COVID-19

If we had based our forecasts on what we experienced earlier, particularly after the market declines in 2012 and 2015, we should have expected to see some signs of recovery in 2020 and an upswing in diamond prices, as a result of declines in inventory levels and lower rough supply. But the pandemic changed the narrative.

One thing is clear, we are not going to jump straight back to normal – or at least what we earlier defined as normal. Thus far, we have we seen very limited goods and traders arriving in Shanghai from India since the outbreak of pandemic. Indeed, given that the development of an effective vaccine is still a long way off, it is reasonable to assume that our supply chain, not to mention international travel, will be affected for a long time yet.

This pandemic brought some tough moments for China’s diamond sector, and especially those brick and mortar retailers who are burdened with high rental and labor costs. Usually sales in December, January and February, which include the Spring Festival, represent almost 50 percent of annual store revenue, and even in the best scenario consumption may recover to near normal levels only in June. This means that retailers will come under real financial strain for at least six months.

Consolidation will accelerate as a result. Big brands with sound financial status and reputation are apt to get more market share during the leaner times. Currently, the top 10 jewelry brands only account for 30 percent of market share in mainland China. This is an evolutionary process, which does not simply mean the big fish eat the small fish. It is more about the survival of the fittest, where the winners are those who can adapt to market change and dare to self-reform.

The expansion of the industry’s digital presence

The market lockdown forced businesses to broaden their digital presence. Social shopping and online/offline integration were embraced during the pandemic by more jewelry retailers than ever before. One major retailer, Zhou Liu Fu, reported that its online business has achieved 30 percent growth during the pandemic, and it was planning to mobilize more stores to try Live Video shopping.

According to research by CCS Insight, China will have an online retail market worth $1.8 trillion by 2022 and will comprise 40 percent of global 5G connections by 2025.

The Shanghai Diamond Exchange building.

Online trading and greater use of digital technology are changing the way diamonds are bought and customers are engaged with our industry.

The pandemic may also bring the change to the value and purchase pattern of consumers. Rational spending and emotional connection may lead to more consumption of diamond fashion jewelry, which is less expensive but authentic and in vogue. This provides a good opportunity for the natural diamond sector to improve its marketing prowess and to reengage with consumers, as they emerge from isolation.

Another consequence of having lived through the COVID-19 pandemic is likely to be a greater awareness of the pitfalls of irresponsible behavior, within society and in respect to the environment. For the diamond industry this will be expressed through increased consumer scrutiny of our supply chain practices, making mechanisms like the Kimberley Process Certification Scheme and WDC System of Warranties more important than ever. Our ability to demonstrate that we have structured platforms to ensure the integrity of our product will work to our advantage.

This lasting crisis reminds us that we must be ready to adapt and adjust during times of unexpected impacts. What we learn during this challenging period will be vital to the future prosperity of our industry.

An open-air market in Shanghai, after the COVID-19 lockdown.

Market growth during a time of crisis

In all likelihood the industry will continue operating in the shadow of COVID-19 well into 2021, meaning that the recovery process will be slower than we would have liked. But that does not automatically translate into lower sales. Forevermark recently reported that it has seen a strong sales recovery in China, with stable average prices and doubled conversion rates in stores. It would suggest that an actual reduction in sales as a result of the pandemic will be limited.

If one tracks the net growth polished diamond imports into China through SDE from 2002 to 2018, one will see an annual increment of 27 percent. This has not always been linear, but rather has been characterized by wave upon wave of accelerated growth.

The 19-year period witnessed three major declines, with the worse of them being experienced in 2019.

Last year, net imports of polished diamonds though SDE equaled $1.851 billion, 32 percent lower than the amount reported in 2018. The rate of decline matched the global average, reflecting our industry’s overall efforts to digest the inventory accumulated in the pipeline at sharply reduced prices. Furthermore, reductions in bank credit forced the upstream to dump inventory to the downstream to gain liquidity, leading to a totally supply driven market in 2019.

Reasons for optimism in China

The key element that will determine the fate of the Chinese diamond market is the fundamental state of the country’s economy, whose growth this decade is being driven largely by consumption. In 2019, domestic consumption represented 41 percent of the nation’s GDP, up 57.6 percent from 2018, the highest increase in eight years.

If over the coming 10 years the Chinese economy is able to maintain a medium to high average growth rate of 5 to 6 percent, the diamond market will likely expand for another decade. In fact, given government’s stimulus policies, some economists estimating that China’s GDP may actually grow by 3 to 4 percent growth in 2020. This would put us on track to return to a more normal track in 2021.

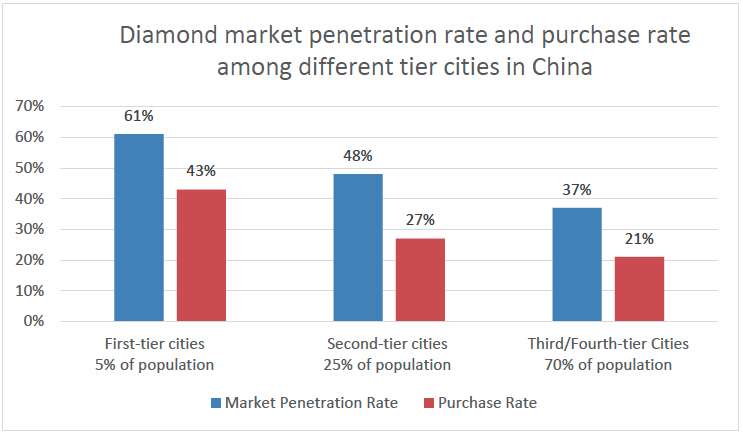

Much of that momentum in the diamond market will come from China’s vast third and fourth tier cities. They account for 70 percent of the total population, and already contribute some 43 percent to the diamond consumption by value. Their potential is considerable, especially if one considers that they lag far behind the first and second tier cities, both in terms of market penetration and the purchase rate. But, thanks to the spread of digital commerce and mobile applications, as well as the expansion into the third and fourth tier cities of leading jewelry retail chains, consumers are getting more opportunities to come into contact with brands and merchandise.

The Chinese diamond market’s growth potential is further enhanced when one looks at the larger picture. China currently accounts for about 15 percent of world diamond retail, which is much lower than that the 28 percent average share that it has of retail in general. A doubling in market size would not seem unreasonable.